Part 1: Understanding the Foundation of Autonomous AI Commerce

This is part 1 of a 3-part series exploring Google’s Agent Payments Protocol (AP2) and its implications for the future of commerce. In this first instalment, we’ll cover what AP2 is, why it matters, and how it fundamentally changes the relationship between AI and commerce.

The Dawn of AI-Driven Commerce

Google has unveiled something that might fundamentally change how we think about e-commerce: the Agent Payments Protocol (AP2). While the name might sound technical, its implications are anything but abstract – this protocol could redefine how we purchase goods and services in the AI era.

At its core, AP2 addresses a simple but revolutionary shift: in the future, many of our purchases won’t be made by us directly, but by AI agents acting on our behalf.

Think about that for a moment. Your digital assistant might soon order your groceries automatically when your refrigerator runs low. It could book your flight precisely when prices hit your target threshold. The same assistant would renew your software subscriptions at the optimal time and even negotiate with other AI agents to secure you the best possible deal – This has been the promise of every technology shift 🙂

This isn’t speculative science fiction – it’s the immediate future that Google and over 60 major financial and technology partners are building with AP2.

Why We Need a New Protocol for Commerce

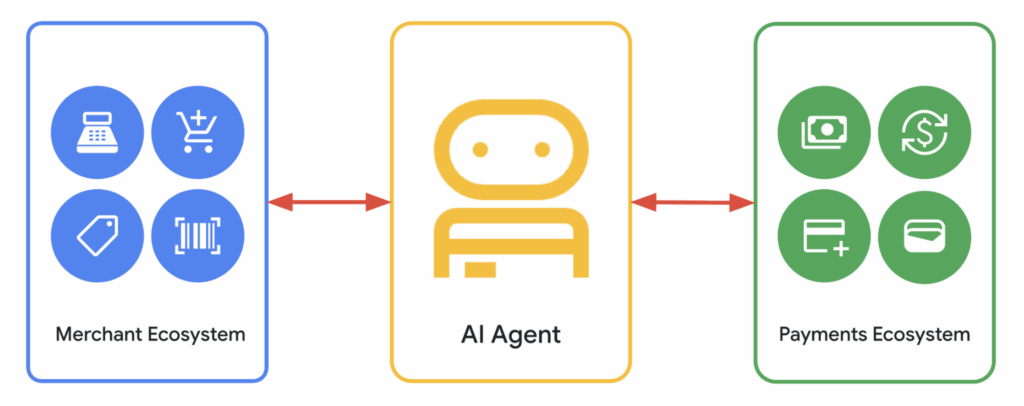

Our existing payment systems were designed for a world where humans click “buy now” buttons. They weren’t built for autonomous agents making purchases on our behalf.

This creates several critical questions: How do we prove we authorized an AI to make purchases? How do merchants verify an AI’s purchasing authority? Who bears responsibility if something goes wrong? And perhaps most importantly, how do we prevent fraud in an agent-commerce world?

AP2 solves these problems through a revolutionary approach: cryptographically-signed “Mandates” that create tamper-proof digital contracts between users, agents, and merchants.

The Three-Mandate Architecture

Core of AP2 lies in its three-mandate system:

1. Intent Mandates: These capture your authorization for AI agents to make purchases under specific conditions. When you tell your agent “buy concert tickets when they become available under $200,” this creates a cryptographically-signed contract containing your identity, authorized payment methods, purchase criteria, and expiration time. This serves as pre-authorization for the agent to act without requiring your real-time approval.

2. Cart Mandates: For purchases requiring your direct review, the agent assembles a shopping cart which you then cryptographically sign. This creates an immutable record of exact items, prices, shipping details, and refund conditions – preventing any post-approval modifications.

3. Payment Mandates: These provide payment networks and card issuers with evidence that an AI agent executed the transaction, enabling appropriate risk assessment while maintaining compatibility with existing payment infrastructure.

All three utilize Verifiable Credentials (VCs) – cryptographically-signed, tamper-evident digital contracts that establish an unbreakable chain of authorization from user intent to payment execution.

A Partner Ecosystem of Unprecedented Scale

What makes AP2 particularly significant is the coalition Google has assembled to support it – over 60 organizations spanning finance, technology, and commerce, including payment networks like Mastercard, American Express, and PayPal; technology platforms such as Salesforce, ServiceNow, and Adobe; and regional commerce giants including Shopee, Lazada, and Airwallex.

As Pablo Fourez, Mastercard’s Chief Digital Officer, put it: they’re “playing an essential role in securing the payments ecosystem – ensuring that trust and safety remain at the core of every transaction.”

Transforming Commerce: The Possibilities

AP2 enables sophisticated commerce scenarios that were previously impossible: autonomous purchasing that keeps your pantry stocked with pet food, automatically switching to grain-free alternatives when they’re on sale; complex multi-vendor transactions coordinating flights, hotels, and activities within a predetermined budget; and enterprise procurement where corporate agents purchase software solutions based on real-time organizational needs.

These use cases represent a fundamental shift from reactive to proactive commerce – where purchases happen automatically based on conditions and parameters you’ve defined in advance.

What This Means For Professionals

For business leaders and professionals, AP2 represents both opportunity and disruption:

For marketers, the center of gravity shifts from last-touch clicks to earlier stages of the purchase journey. Those who can aggregate and direct buyer intent will hold new power in this ecosystem. Developers face exciting opportunities as a new ecosystem of agent-enabled commerce applications awaits creation, with the protocol already available as version 0.1 with complete documentation and sample code.

Business strategists will need to consider how to position their companies in a world where AI agents, not humans, make many purchasing decisions. Meanwhile, compliance and security professionals must adapt to emerging frameworks for authorization, authentication, and accountability that will require updated risk models.

What’s in it for Banks and Fintechs?

For financial institutions, AP2 represents a rare opportunity to position themselves at the forefront of AI-driven commerce before mass adoption occurs.

Traditional banks face the risk of disintermediation as technology companies increasingly insert themselves between financial institutions and consumers. AP2 offers banks a chance to remain central to the transaction flow by becoming credential providers and mandate issuers in this new ecosystem. By integrating with AP2, banks can ensure they maintain their position as trusted financial intermediaries even as commerce shifts to agent-mediated channels.

For fintechs, AP2 creates entirely new product categories and service opportunities. Specialized credential providers could emerge to manage mandate issuance and verification. Payment orchestration platforms could expand to handle agent-based transactions. Risk management services could develop AI-specific fraud detection models tailored to this new transaction pattern.

The protocol also enables novel financial products: dynamically adjusting credit lines based on agent behavior, specialized insurance for agent transactions, and automated dispute resolution services. Early movers who build expertise in AP2 integration could establish themselves as essential infrastructure providers as adoption grows.

Perhaps most significantly, AP2 opens the door to true embedded finance at scale. When AI agents can securely initiate transactions across platforms without human intervention, financial services become programmatically embedded into everyday activities in ways that weren’t previously possible.

AP2 represents a foundational step toward an autonomous economy where AI agents conduct increasing portions of commercial activity. While still in development with no consumer implementations yet launched, the protocol’s extensive partner ecosystem and thoughtful design suggest it’s positioned to become a standard for agent commerce.

In Part 2, we’ll dive deeper into the technical implementation of AP2, exploring its security architecture, cryptocurrency integration, and how it proposes to manage to bridge traditional finance with emerging Web3 capabilities.

What do you think about AI agents making purchases on your behalf? Would you trust an agent with your payment information if it had clear limitations you controlled? Share your thoughts in the comments!